#DEPRECIATION EXPENSE JOURNAL ENTRY HOW TO#

If you didn’t see a depreciation account, here’s how to create one. If you see an account with “Depreciation” in the Name column, “Other Expense” in the Type column, and “Depreciation” in the Detail Type column, then your chart of accounts is already set up.In the Filter by name field, enter “depreciation”.Go to Settings ⚙ and select Chart of accounts.To avoid creating duplicates, make sure you don’t already have a depreciation account. Step 1: Check to see if you already have a depreciation account You should also review this article from the IRS. We recommend working with them to regularly review how you track depreciation. Note: Calculating asset depreciation is difficult. Instead, you need to manually track depreciation using journal entries. QuickBooks Online doesn't automatically depreciate fixed assets. Instead, depreciation is merely intended to gradually charge the cost of a fixed asset to expense over its useful life.In QuickBooks Online, after you set up your assets, you can record their depreciation. Market value may be substantially different, and may even increase over time. The Difference Between Carrying Cost and Market Valueįinally, depreciation is not intended to reduce the cost of a fixed asset to its market value. Any expenditure for which the cost is equal to or more than the capitalization limit, and which has a useful life spanning more than one accounting period (usually at least a year) is classified as a fixed asset, and is then depreciated. They reduce this labor by using a capitalization limit to restrict the number of expenditures that are classified as fixed assets. The Capitalization Limitĭepreciation and a number of other accounting tasks make it inefficient for the accounting department to properly track and account for fixed assets. The one exception is a capital lease, where the company records it as an asset when acquired but pays for the asset over time, under the terms of the associated lease agreement. This is because a company has a net cash outflow in the entire amount of the asset when the asset was originally purchased, so there is no further cash-related activity. Instead, they can more easily be associated with an entire system of production or group of assets, such as a production line.ĭepreciation is considered an expense, but unlike most expenses, there is no related cash outflow.

In reality, revenues cannot always be directly associated with a specific fixed asset. Thus, if you charged the cost of an entire fixed asset to expense in a single accounting period, but it kept generating revenues for years into the future, this would be an improper accounting transaction under the matching principle, because revenues are not being matched with related expenses.

The reason for using depreciation to gradually reduce the recorded cost of a fixed asset is to recognize a portion of the asset's expense at the same time that the company records the revenue that was generated by the fixed asset. These entries are designed to reflect the ongoing usage of fixed assets over time.ĭepreciation is the gradual charging to expense of an asset's cost over its expected useful life.

#DEPRECIATION EXPENSE JOURNAL ENTRY SERIES#

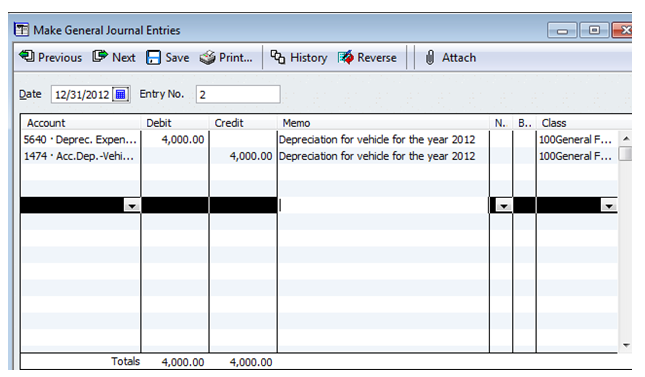

The accounting for depreciation requires an ongoing series of entries to charge a fixed asset to expense, and eventually to derecognize it. What is the Accounting Entry for Depreciation?

0 kommentar(er)

0 kommentar(er)